Toxic Debt vs. Productive Debt: A Strategic Guide to Cutting the Cord

Let's cut through the noise. Not all debt is created equal.

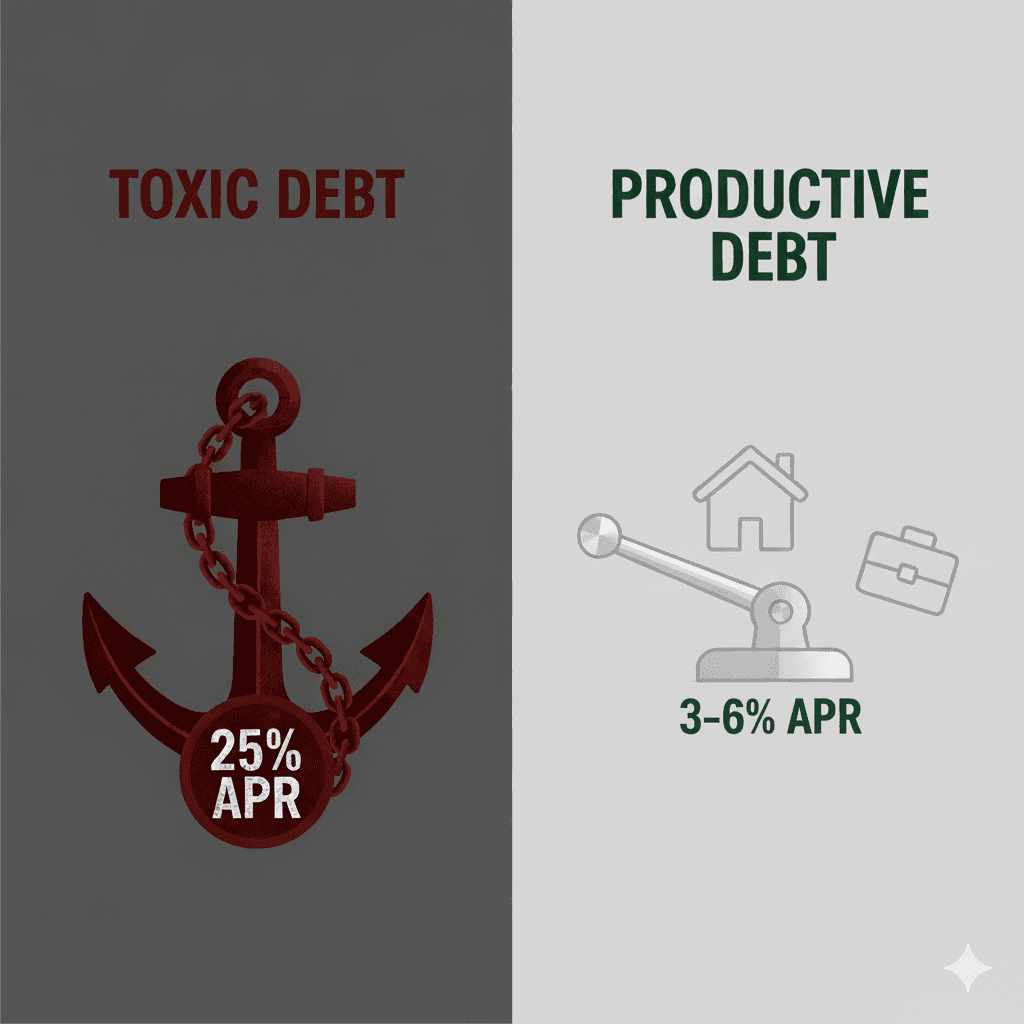

Some debt is a tool. This is Productive Debt. Think of a sensible, low-rate mortgage building equity in a home, or a strategic loan used to acquire a cash-flowing business. This debt is a lever, designed to increase your net worth over time.

Then, there’s Toxic Debt. This is the anchor. It’s high-interest consumer debt—credit card balances with 25% APRs, personal loans, and anything else that drains your wealth every single month. It doesn’t build anything. It just sinks you.

If you’re carrying toxic debt, your financial plan has a massive leak. Your top priority isn't picking the perfect stock; it's plugging that leak. Immediately.

Here’s how we do it.

The Two Takedown Methods: Snowball vs. Avalanche

When it comes to eliminating toxic debt, there are two popular schools of thought.

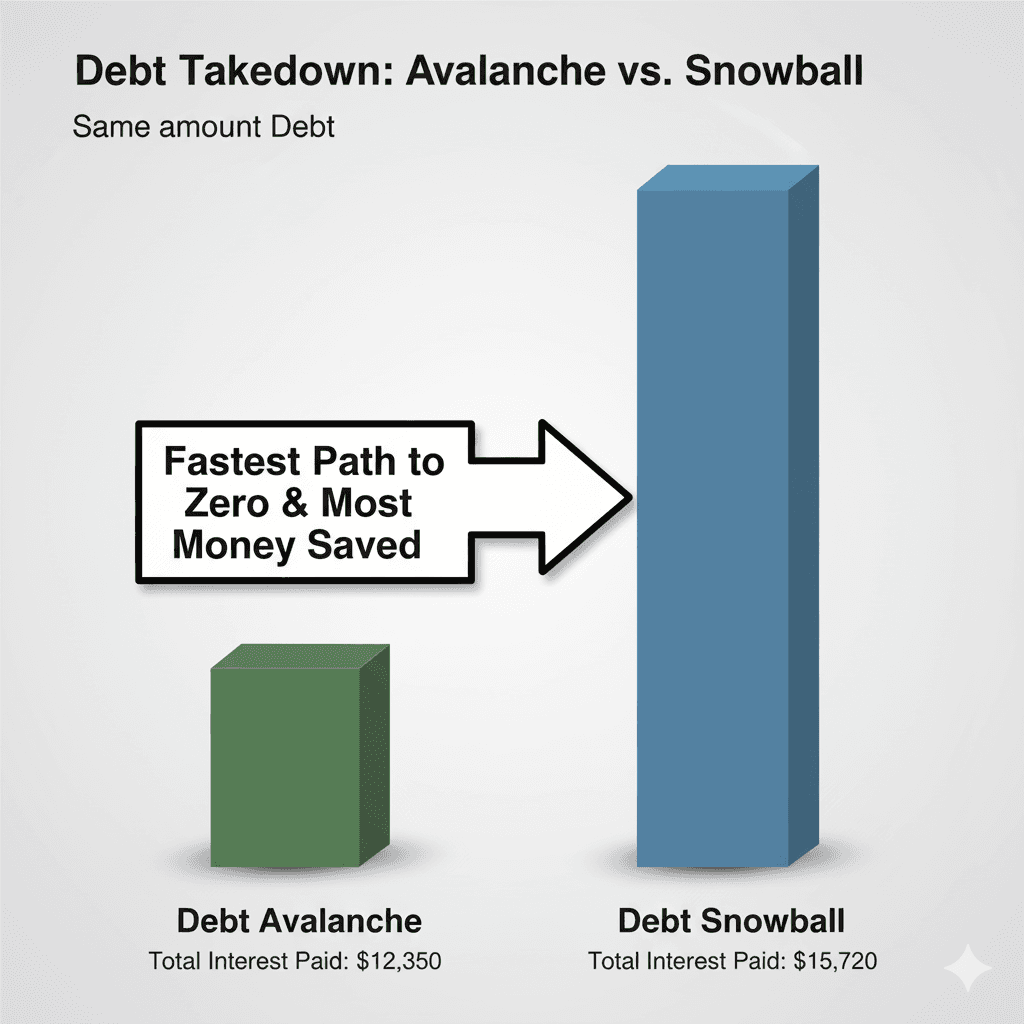

The Debt Snowball: With this method, you pay the minimum on all your debts, then throw every extra dollar at the one with the smallest balance first. Once it's gone, you "snowball" that payment onto the next smallest, and so on. The big win here is psychological. Knocking out small debts fast feels good and builds momentum.

The Debt Avalanche: This is the mathematical approach. You pay the minimum on everything, but you focus all your extra firepower on the debt with the highest interest rate, regardless of the balance. Once that's paid off, you attack the debt with the next-highest APR.

My Stance: The Avalanche Is the Smart Play

While the Snowball method has its behavioral merits, I almost always recommend the Debt Avalanche method to my clients.

Why? Because my job is to save you the most money. Period.

Interest is the enemy. It’s a relentless headwind working against you. By tackling your highest-interest-rate debt first, you are systematically eliminating the most expensive, most destructive debt in your life. This is the approach that will get you to zero and save you the most money in interest payments along the way.

Some might argue we should consider the tax-deductibility of the interest. But let's be blunt: for the kind of toxic debt we're talking about (credit cards, personal loans), the interest is almost never tax-deductible. The APR is the only number that matters. The highest one has to go first.

Your 4-Step Avalanche Action Plan

Ready to get strategic? Here’s the plan.

- List Every Debt: Create a simple spreadsheet. List who you owe, the total balance, the minimum monthly payment, and—most importantly—the exact interest rate (APR).

- Rank by APR: Sort this list from the highest interest rate to the lowest. This is your hit list.

- Fund the Attack: Go through your budget and find your "attack money"—the extra cash you can commit to this plan above your minimum payments.

- Execute: Pay the minimums on every single debt except the one at the top of your list. You will pay the minimum plus all your extra "attack money" on that single, high-interest debt until it is completely gone.

When it's gone? Don't go buy a latte. You take all the money you were paying on it (minimum + attack money) and apply it to the next debt on your list. Repeat this until you are free.

The Best Guaranteed Return You'll Ever Get

Look, I'm a financial advisor. I spend my days analyzing market returns. But I can tell you this: paying off a 25% APR credit card is the equivalent of earning a 25% guaranteed, tax-free return on your money.

You cannot find that in any stock, bond, or fund.

Eliminating debt isn't about restriction. It’s about liberation. It's the single most effective move you can make to free up massive cash flow—cash flow we can then use to build your real financial plan and start building your wealth.

Let's stop bailing water and start plugging the leak.