Is Your Future Self Going to Thank You—Or Resent You?

There was a popular ad campaign a while back with a tagline that was almost uncomfortably brilliant: "Don't let your future self hate you."

It usually involved someone making a questionable money choice, much to the visible horror of their older, wiser self. It’s funny, but let’s be honest—it lands because it taps into a very real, quiet anxiety many of us carry.

Am I doing enough? Am I missing something? Am I making a huge mistake by... doing nothing?

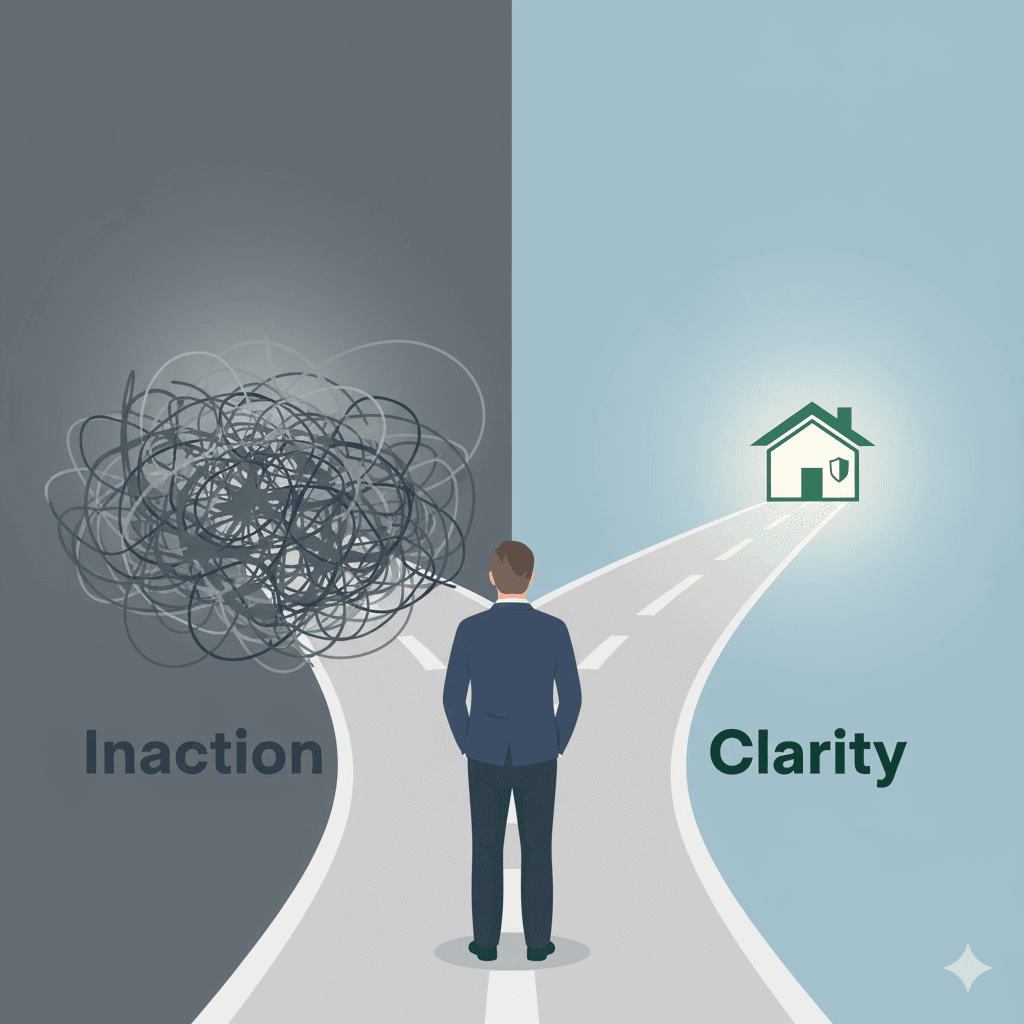

This anxiety has a name: Decision Paralysis.

It’s that feeling of being so overwhelmed by the sheer complexity of it all—stocks, bonds, 401(k)s, Roth IRAs, annuities, insurance, college savings—that you just... freeze. The fear of making the wrong move becomes so great that you end up making no move at all.

You’re stuck in neutral. And you are not alone.

This isn't just a feeling; it's a documented phenomenon. A 2023 study found that nearly 60% of Americans feel they are behind on retirement saving, yet only a fraction of them have sought professional guidance.

That’s decision paralysis in action. It’s the massive, stressful gap between "I know I should do something" and "I actually did something."

Here’s the hard truth: in finance, inaction is an action. It's a choice that has a real, quantifiable cost.

Every year you delay, the awesome power of compound growth works against you instead of for you. That "gift" of time you just gave away means your 60-year-old self will have to save thousands, or even tens of thousands, more per year just to catch up to where you could have been.

Biting the bullet now, making the tough calls today, isn't a punishment.

It's the single greatest gift you can give to the 70-year-old you. It’s the difference between a future self who is stressed and scraping by, and one who is secure, confident, and grateful for the person you were today.

So, how do you break this cycle?

You stop trying to do it all yourself. You find a guide.

Working with a fiduciary advisor isn't supposed to be another daunting task on your to-do list. It is the solution to the paralysis itself.

My job isn't to sell you a product. My job is to sit down with you, listen to all those overwhelming thoughts, and simplify the complexity. It's to take that jumble of options and architect a clear, step-by-step path that is yours and yours alone. I bear the burden of the financial details so you can finally feel the profound relief of having a plan.

You don’t need to have all the answers to get started. You just need to make one decision.

Let’s make your future self proud. Forget about the overwhelming 10-year plan for a minute. Just focus on the next 15-minute conversation.

Let's challenge that paralysis, today. Make the one decision to simply start the conversation. Schedule a no-obligation call to explore—not commit, just explore—what a real plan could look like for you.

Your future self will thank you for it!