Why 'Just Investing' Is a Risky Retirement Strategy (And What to Do Instead)

As a financial advisor, the question I hear most often is, "How are my investments doing?"

It’s a great question. And let's be clear: a well-managed, diversified investment portfolio is a powerful engine for building wealth. It’s a critical piece of your retirement puzzle.

But what if I told you it’s just that—one piece? What if focusing only on your portfolio was actually the riskier strategy for your retirement?

In my world, we run sophisticated projections to determine a "Probability of Success." This is a simple-sounding term for a complex calculation: what is the statistical likelihood that you can live your desired retirement lifestyle, for your entire life, without running out of money?

A "good" investment-only plan might come in with an 85% or 90% success rate. That sounds pretty high, right?

But let me ask you: if you were boarding a plane, would you be comfortable with a 90% chance of landing safely? Or would you be wondering what happens in that other 10% of scenarios? When it comes to your life’s savings, 90% isn't 100%. That 10% gap is where "hope" lives.

And hope is not a financial strategy.

This is where we need to stop thinking like short-term investors and start thinking like long-term architects. We need to build a plan that is resilient, one that is engineered to withstand the storms.

I was fascinated by a landmark study from Ernst & Young that looked at this exact problem. They analyzed the outcomes of retirement plans and found something remarkable. When you strategically integrate structured, insurance-based products—tools designed to provide guarantees, like some annuities or life insurance policies—to cover your essential baseline expenses, the average success rate of the exact same plan jumps dramatically.

How much? To over 95%.

Let that sink in. By simply re-allocating assets to secure your non-negotiables, the reliability of the entire plan increases significantly.

This isn’t about replacing your growth investments. It’s about "de-risking the floor" of your retirement.

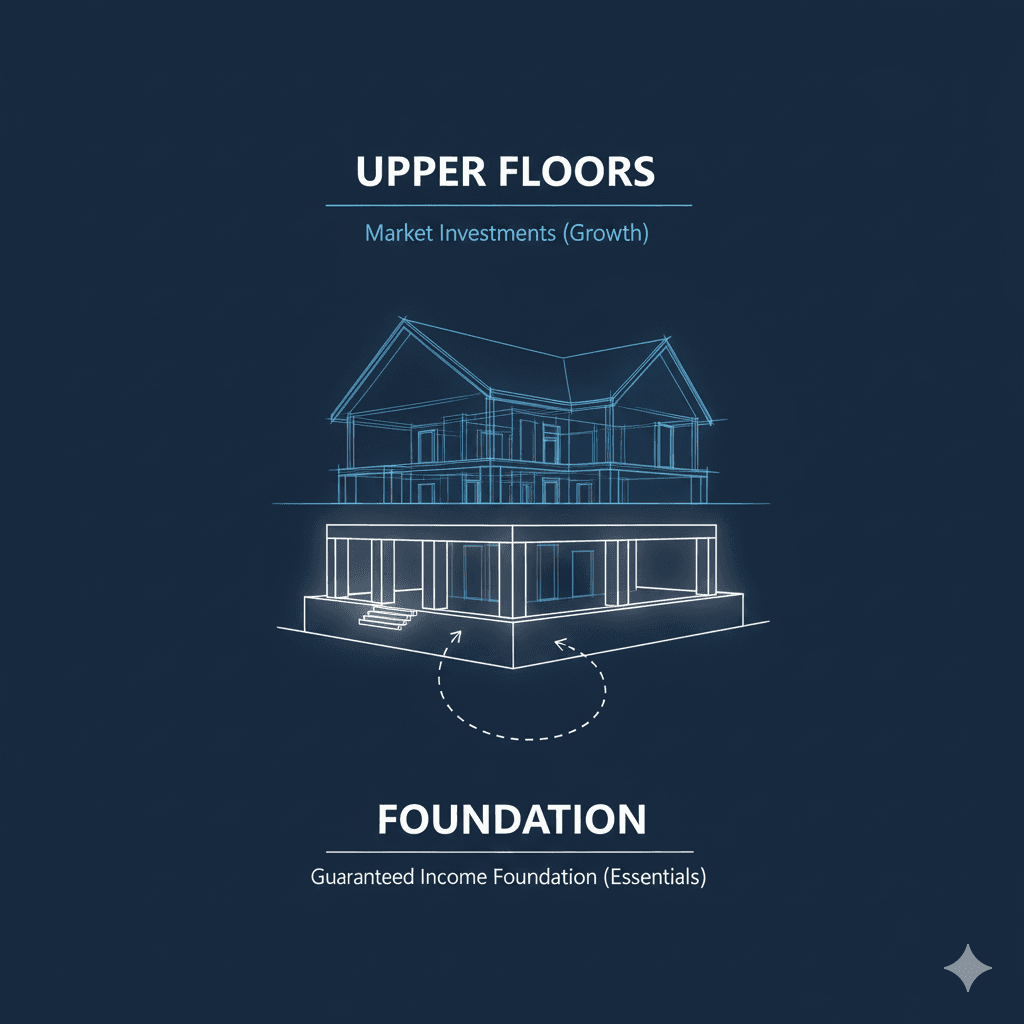

Think of it like building a custom home. Your investment portfolio—your stocks, bonds, and mutual funds—is the beautiful second floor, the granite countertops, and the infinity pool. That’s where your growth, your upside, your "wants" live.

But none of that matters if the concrete foundation is cracked.

The guarantees are the foundation. They are the part of the plan designed to ensure that no matter what happens in the market—in a 2008 crash or a 2022 pullback—your lights stay on, your mortgage is paid, and your core lifestyle is secure.

Once that foundation is set in stone, we can be even more strategic (and perhaps even more effective) with the growth-focused parts of your portfolio.

As your financial advisor—and as a fiduciary—my job isn't to "sell" you a product. My job is to use every single tool in the toolkit to build the most resilient, most successful plan possible for your specific life. Frankly, any advisor who only talks about investments is working with an incomplete set of blueprints. They’re building a beautiful house with no foundation.

So, the next time we meet, let's have a different conversation. Let’s move beyond a simple "portfolio review" and have a true "plan architecture" discussion.

Let's talk about your foundation. Because a great portfolio is nice, but a plan that works is truly everything for most families and individuals.